Crazy America has rarely ventured into the rollercoaster world of capital markets.

But with fever for Game Stop and an assorted motley crew of other stocks suddenly gripping the country, we have had no choice but to take a look.

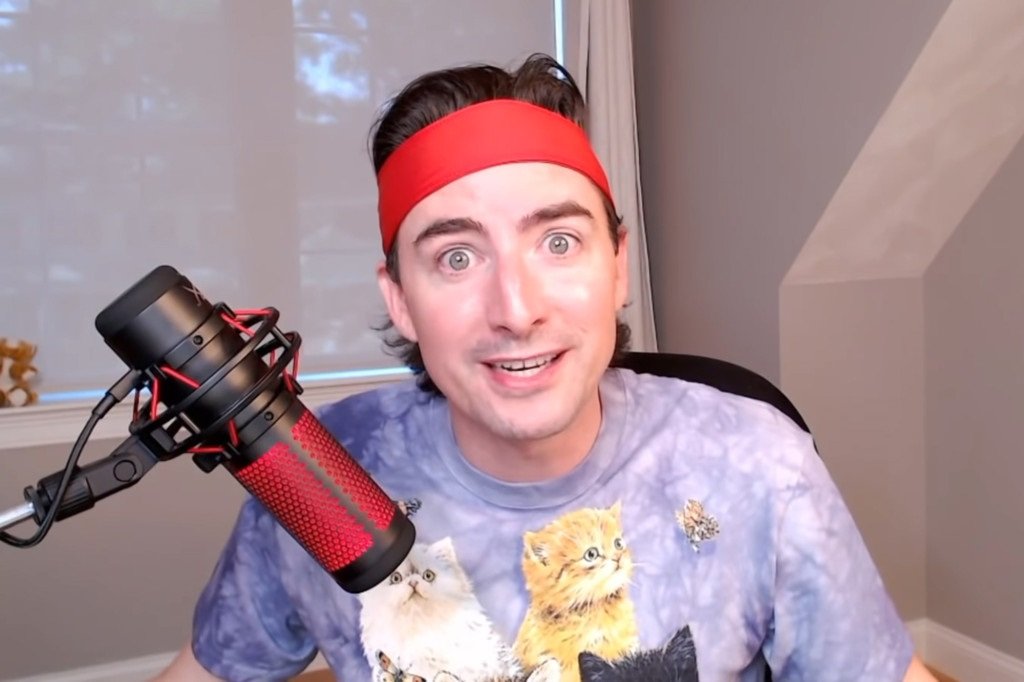

Friday was the day the nation properly met Keith Gill, the 34-year-old former insurance salesman who is the driving force behind the crazy market moves that we have been seeing.

Gill finally spoke out on the past week of financial chaos that he started.

“I didn’t expect this,” he said in an interview with the Wall Street Journal. “This story is so much bigger than me.”

The GameStop mania has history dating back to June of 2019 when Gill began posting his investment activity in GameStop to Reddit’s WallStreetBets forum, WSJ reports.

Gill said he invested in GameStop because he believed, contrary to the hedge fund shorts, that there was life yet in bricks and mortar game story – particularly with a new generation of consoles on the horizon, along with new games.

As we know, many of the biggest hedgies thought the exact opposite and bet on GameStop failing and shorted stocks.

For now at least, it seems Gill was right and the hedge funds were wrong.

The basement dwelling day-trader turned cult hero recently posted a screenshot that showed a $20M gain on his GameStop shares.

But Gill’s market moves have done more than just make him rich super quick. The ensuing result has been one veteran financial experts can’t really understand or explain.

Hordes of Reddit users flocked to investing apps like Robinhood to quickly buy shares of GameStop causing the stock to rise more than 255% this week. For context, at the beginning of the year the stock was trading around $18 a share. It’s now hovering around more than $330.

Hedge funds like Melvin Capital Management and Maplelane Capital have lost billions of dollars. And there’s a growing army of “regular people” turning to trading as a way to get back at huge hedge funds which have seemingly “manipulated the market” to their benefit for years without penalty, the traders say.

The stock was seeing such high interest Thursday that trading platforms such as Robinhood and Fidelity halted the trade of GameStop and a dozen other retailer stocks that are included in the investing phenomenon. But after receiving a swarm of critical feedback from traders and politicians alike (including Rep. Alexandria Ocasio-Cortez and several republicans) Robinhood reinstated limited buying of the options again Friday morning.

The Securities and Exchange Commission put out a statement Friday saying it will “act to protect retail investors when the facts demonstrate abuse or manipulative trading activity.” But so far there hasn’t been any actual real allegations of manipulation. Gill told the WSJ he hasn’t heard from SEC, too.

Gill tells the WSJ, “People were doing a quick take, saying GameStop was the next Blockbuster,” he said. “It appeared many folks just weren’t digging in deeper. It was a gross misclassification of the opportunity.”

His YouTube channel “RoaringKitty” has drawn hundreds of thousands of Reddit users to share their investment experience with the GameStop app. Many have shared stories of incredible gains and paying off bills they were previously unable to.

Mrs. Gill told the WSJ her son was always interested in money growing up.

“He would get money from those scratch tickets that people didn’t know they’d won. People would throw them on the ground…A lot of times there was still money on them,” she told the paper.

According to the WSJ, after Thursday’s market close his brokerage account held $33M, including GameStop stock.

The YouTuber and investor graduated from Stonehill College in 2009 and now lives in New Hampshire. Before hitting his astronomical gains with GameStop stock, he worked in marketing for MassMutual, but now sees continued work on his YouTube channel and the purchase of a house in his future, the paper reports.

A former high school and college distance runner, Gill told the WSJ he has always had a dream of building an indoor track facility or field house in Brockton.

“And now, it looks like I actually could do that,” he told the paper.